Car title loans provide secured financing for individuals using their vehicle's title as collateral, catering to those with limited credit or traditional banking barriers. Industry standards focus on borrower retention, transparency, and fairness, setting clear guidelines on interest rates, repayment periods, and reclaim processes. These standards protect borrowers and lenders, offering a reliable source of emergency funds without compromising financial stability. Lenders assess vehicle value for same-day funding with fair terms, adhering to industry benchmarks for a secure borrowing experience.

“Unraveling the complexities of the car title loan industry is crucial for both borrowers and lenders. This article delves into the fundamental standards shaping this unique form of secured lending. From understanding the core concepts—how these loans work, eligibility criteria, and their purpose—to exploring key industry regulations, we dissect vital aspects like licensing, interest rate caps, and consumer protection measures. By the end, readers will grasp the essential standards guiding the car title loan market.”

- Understanding Car Title Loan Basics:

- – Definition and purpose of car title loans

- – How car title loans work

Understanding Car Title Loan Basics:

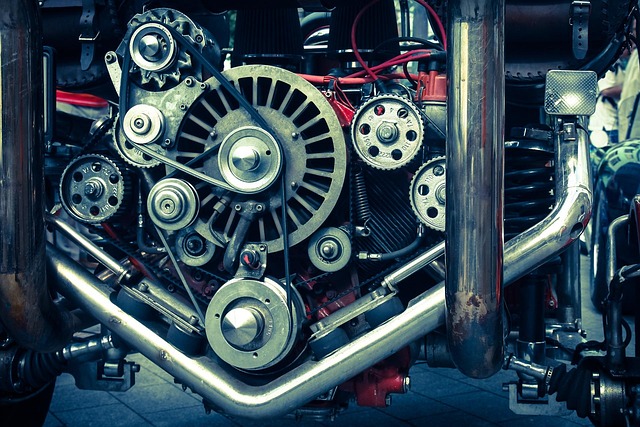

Car title loans are a type of secured lending where borrowers use their vehicle’s title as collateral. This alternative financing option is popular among those seeking quick cash, especially in situations where traditional bank loans might be inaccessible. Understanding the basics involves grasping that these loans provide a financial solution for individuals with poor or no credit history, offering a convenient and direct approach to accessing funds. The process typically involves applying for a loan, providing vehicle information, and submitting proof of income, with the lender retaining the car title until the debt is repaid.

In the car title loan industry standards, keeping your vehicle is a key aspect, ensuring borrowers retain possession of their cars during the loan period. This feature distinguishes it from other secured loans where the asset might be repossessed upon default. Fort Worth Loans, for instance, adheres to these standards by allowing borrowers to keep their vehicles while providing a financial safety net. This approach has made car title loans an attractive option for many seeking immediate financial relief, offering a practical solution when traditional banking services are not readily available.

– Definition and purpose of car title loans

A car title loan is a type of secured loan where borrowers use their vehicle’s title as collateral to secure funding. In simple terms, it allows individuals with a clear vehicle ownership title to borrow money by pledging their car as security. The primary purpose of this industry standard is to provide quick access to emergency funds for those in need without the stringent credit check requirements often associated with traditional bank loans. This makes car title loans an attractive option for borrowers who have poor or no credit history, or those seeking a fast and convenient source of cash for various purposes, such as covering unexpected expenses or paying off immediate debts.

The car title loan industry standards focus on ensuring that lenders provide transparent terms and conditions to protect both parties involved. It involves setting clear guidelines on interest rates, repayment periods, and the process of reclaiming the vehicle if the borrower defaults on payments. These standards aim to maintain fairness and prevent predatory lending practices, especially since borrowers are putting up their assets as collateral. By adhering to these industry benchmarks, lenders can offer secure and reliable secured loans, catering to individuals’ needs for emergency funds without compromising their financial stability.

– How car title loans work

Car title loans are a type of secured lending that uses a vehicle, typically a car, as collateral. This alternative financing option is popular among borrowers who need quick access to cash and may not qualify for traditional bank loans. The process involves borrowing money from a lender by offering your vehicle’s title as security. Unlike standard loans where credit history plays a significant role, car title loans focus primarily on the value of your vehicle.

Once approved, lenders provide same-day funding or quick funding, allowing borrowers to access their funds promptly. This accessibility makes car title loans an attractive option for those facing financial emergencies or seeking a fast solution. The industry standards in this sector ensure that both parties understand the terms and conditions clearly, with transparent borrowing processes and fair interest rates, catering to the needs of borrowers who require immediate financial support.

In navigating the car title loan industry, adhering to key standards is paramount for both lenders and borrowers. These standards ensure transparency, fairness, and security in transactions, facilitating access to capital for those in need while protecting consumer rights. By understanding and respecting these industry benchmarks, participants can foster a robust and ethical lending environment.